There are a variety of factors to consider when purchasing insurance for your car. The state minimum requirements for auto insurance coverage vary depending on the state in which you reside; for example, in the state of Colorado, the minimum requirements for auto insurance coverage is 25/50/25, which pertains to bodily injury liability limits.

There are a variety of factors to consider when purchasing insurance for your car. The state minimum requirements for auto insurance coverage vary depending on the state in which you reside; for example, in the state of Colorado, the minimum requirements for auto insurance coverage is 25/50/25, which pertains to bodily injury liability limits.

This translates out into $25,000 per person, $50,000 per incident, and $15,000 for property damage. Keep in mind that these are the absolute minimum limits required by law. Winston Salem used car dealer, Tracy Myers says, “I would definitely recommend carrying more than that in bodily injury and liability/property damage coverage. It’s just the smart thing to do.”

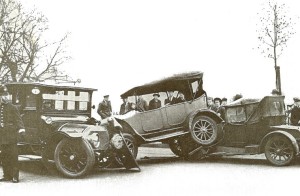

If you cause an accident, or even cause a multiple-car pile-up where a few people are injured, chances are that you would cause more damage than you think. The extra premium you are paying for more coverage is well worth it (and this is coming from someone who is pretty conservative when it comes to spending money).

Comprehensive and Collision Coverage

It is also important to consider what deductible amounts would work for your used car situation. It is important to keep in mind that the higher your deductibles are, the lower your premium amount for that year is.

Also, there are two kinds of deductibles: comprehensive and collision. Comprehensive pertains to any damage caused to your vehicle by vandalism, acts of God, hit-and-run, and hitting an animal. Collision has to do with actually hitting another vehicle while on the road.

Comprehensive claims do not affect your future insurance premiums, but collision claims do negatively affect you future premiums. So, I feel that you should have a lower comprehensive deductible, and a higher collision deductible.

My personal auto policy has a comprehensive coverage of $100 and a collision of $1000. Also, glass is covered under the comprehensive deductible. Some insurance companies have a $0 deductible for glass coverage, so ask your agent about this.

Used Cars Worth Less than $2000

If you are driving an older car that is not worth more than $2000, then cover it with liability only insurance. That way, you are not paying for a collision deductible if it would cost you more to pay out the deductible than the vehicle is actually worth. However, don’t forget about the bodily injury liability coverage, as this could cover you if you are ever at fault in an accident. If you injure someone, you cannot simply claim that you are broke and have no coverage— you will still have to pay for the injuries or property damage regardless.